- Paramount's $30 per share, all-cash offer provides superior value and greater regulatory certainty than Netflix's sliding scale merger consideration which, according to WBD's own preliminary proxy statement filed with the SEC on February 9, ranges from a minimum of $21.23 to a maximum of $27.75 per share in cash (depending on debt levels on Discovery Global at the time of separation)

- Paramount has enhanced its offer with a $0.25 per share "ticking fee," payable to WBD shareholders for each quarter its transaction has not closed beyond December 31, 2026, underscoring Paramount's confidence in the speed and certainty of regulatory approval for its transaction

- Paramount will fund $2.8 billion termination fee payable to Netflix and offers solutions to WBD's debt financing costs and obligations

- Paramount complied on February 9, 2026 with the DOJ's Second Request for Information related to its all-cash tender offer to purchase shares of Warner Bros. Discovery

- Paramount also secured clearance for its tender offer from the foreign investment authorities in Germany on January 27, 2026

- Letter to the WBD Board of Directors details Paramount's amended offer and urges the Board to exercise its contractual right to negotiate with Paramount by declaring that the amended offer could reasonably be expected to result in a superior proposal

- Paramount reiterates intention to solicit proxies against approval of Netflix transaction at WBD special shareholder meeting

- PARAMOUNT URGES WBD SHAREHOLDERS TO REGISTER THEIR PREFERENCE FOR PARAMOUNT'S SUPERIOR OFFER WITH THE WBD BOARD OF DIRECTORS BY TENDERING THEIR SHARES TODAY

LOS ANGELES and NEW YORK, Feb. 10, 2026 /PRNewswire/ -- Paramount Skydance Corporation (NASDAQ: PSKY) ("Paramount") today announced it has amended its $30 per share, all-cash tender offer to acquire Warner Bros. Discovery, Inc. (NASDAQ: WBD) ("WBD") with enhancements that surpass the standard needed for the WBD Board to engage on Paramount's superior proposal.

Paramount's enhanced offer provides definitively superior value and certainty, as reflected in the following added provisions and distinguishing elements:

- Ticking fee: To underscore confidence in the speed and certainty of its regulatory pathway, Paramount is adding an incremental cash consideration to WBD shareholders of $0.25 per share – equivalent to approximately $650 million cash value each quarter – for every quarter the transaction is not closed beyond December 31, 2026.

- Termination fee: Paramount will fund the payment of the $2.8 billion termination fee due to Netflix concurrent with the termination of the Netflix agreement as set forth in the revised proposed merger agreement filed with the amended tender offer.

- Debt financing cost: Paramount will eliminate WBD's potential $1.5 billion financing cost associated with its debt exchange offer by fully backstopping an exchange offer that relieves WBD of its contractual bondholder obligations. Paramount will fully reimburse WBD's shareholders for the $1.5 billion fee, without reduction to the separate $5.8 billion reverse termination fee, in the unlikely event that (i) the exchange is not successful, and (ii) the Paramount transaction does not close.

- Bridge loan refinancing: If WBD's financing sources will not extend the maturity of WBD's existing $15 billion bridge loan, Paramount's debt financing sources are fully prepared to do so (with any incremental costs covered by Paramount). Alternatively, Paramount will permit WBD to structure permanent financing in any way it chooses so long as the debt is redeemable at a commercially reasonable cost.

- Interim operating covenants: Paramount will provide WBD flexibility between signing and closing, including by matching any comparable Netflix interim operating covenants.

- Discovery Global Business Protections: To provide WBD shareholders further certainty of closing, Paramount is open to discussing with the WBD Board of Directors contractual solutions to account for the possibility of continuing deteriorating financial performance beyond what WBD is currently projecting for its linear network business.

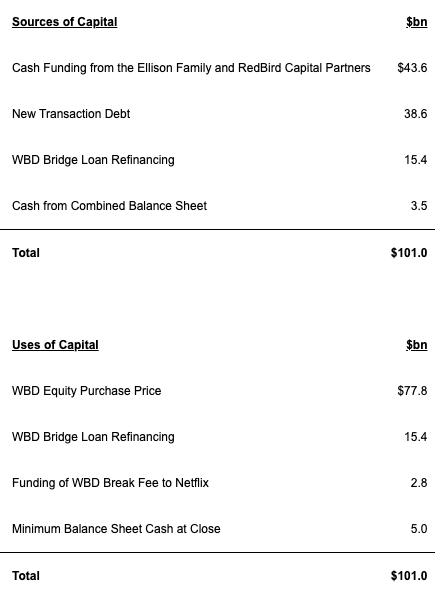

- Fully Financed Offer with No Financing Condition: Paramount's amended offer is fully financed by an increased $43.6 billion of equity commitments from the Ellison Family and RedBird Capital Partners and $54.0 billion of debt commitments from Bank of America, Citigroup and Apollo.

- Personal Guarantee from Larry Ellison: As with Paramount's December 22 offer, Paramount's financing includes an irrevocable personal guarantee from Larry Ellison of $43.3 billion, covering the equity financing for Paramount's amended offer as well any damages claims against Paramount.

- Netflix's Uncertain Range of Cash Plus Equity in the Declining Discovery Global: In sharp contrast to the value and regulatory certainty provided by Paramount's offer, the Netflix deal asks WBD shareholders to approve a transaction where they do not have any idea how much actual cash consideration they will receive, since it is predicated upon the financial condition of Discovery Global at the time of separation and its resulting debt capacity.

Under the Netflix merger agreement, WBD would need to place $17 billion in debt on Discovery Global at time of separation to achieve the high end of the merger consideration range, if the separation were to occur on June 30, 2026. WBD has not provided WBD shareholders any financial information about Discovery Global to demonstrate that Discovery Global could support that quantum of debt.

Discovery Global's closest comparable company, Versant Media, debuted this January with ~1.25x net leverage. Versant began trading at ~4.5x EV / EBITDA and has since seen its multiple contract to ~3.5x EV / EBITDA. At this valuation multiple, Discovery Global would have no equity value. For reference, WBD's own financial advisors produced a discounted cash flow analysis that yielded a low of just 72 cents per share.

Based upon Paramount's analysis, if Discovery Global is spun off with leverage in line with Versant, the Netflix cash consideration would be reduced to $23.20 per share. Assuming both a multiple and leverage ratio in line with Versant, Discovery Global's equity value would be ~$3.55 per share, resulting in a total package value of only ~$26.75 for the Netflix deal. Paramount's $30.00 all-cash offer is 12% higher.

David Ellison, Chairman and CEO of Paramount, said: "The additional benefits of our superior $30 per share, all-cash offer clearly underscore our strong and unwavering commitment to delivering the full value WBD shareholders deserve for their investment. We are making meaningful enhancements – backing this offer with billions of dollars, providing shareholders with certainty in value, a clear regulatory path, and protection against market volatility."

Paramount continues to make progress in its regulatory clearance process. On February 9, 2026, Paramount Skydance Corporation certified that is has complied with the Department of Justice's December 23, 2025, Second Request for Information related to its all-cash tender offer to purchase shares of Warner Bros. Discovery. Paramount's certification of compliance commences a 10-day waiting period pursuant to 16 CFR 803.10(b)(2)(i) and 16 CFR 803.20(c). Paramount continues to engage constructively with antitrust enforcers and other regulators around the world to secure regulatory clearances and approvals for its tender offer.

Separately, Paramount had also secured clearance for its tender offer from the foreign investment authorities in Germany on January 27, 2026.

Paramount's acquisition of WBD is pro-consumer, pro-creative talent and therefore pro-competitive – and importantly addresses the concerns raised by content creators, the talent community and theatrical movie exhibitors. It will strengthen Hollywood's iconic role in global media which has been under continuous pressure from tech and streaming giants over the last two decades.

WBD is racing against the clock to force its shareholders to vote without full financial disclosure regarding the financial condition of Discovery Global, even though that will determine the amount of cash merger consideration they will receive from Netflix and would provide greater certainty on how to value the stub equity.

WBD accelerated its timetable after Paramount stated that it would run a director slate at WBD's upcoming 2026 annual meeting.

WBD shareholders deserve a real choice and the truth about how the two transactions compare. Paramount's offer is transparent and certain — a fixed value of $30 per share in cash. The Netflix transaction is complex and uncertain – a range with a low of $21.23 to a high of $27.75 per share in cash, plus equity in Discovery Global whose business is in decline and would need to support an unrealistic debt load of $17 billion (at June 30, 2026) to achieve the high end of the Netflix consideration range.

Paramount will solicit proxies against approval of the Netflix transaction at WBD's upcoming special meeting.

Paramount today sent the following letter to the WBD Board outlining its amended offer:

Dear Directors:

Paramount Skydance Corporation ("Paramount", "we", "our" or "us") is pleased to revise the terms of our pending offer (the "Revised Offer") to acquire all outstanding shares of Series A common stock of Warner Bros. Discovery, Inc. ("WBD" or "you") for $30.00 per share in cash as follows:

- To underscore our confidence in our ability to secure antitrust clearance and the progress we have made to date, we have added a $0.25 per share "ticking fee" in incremental cash to WBD shareholders for every quarter that our transaction has not closed, beginning to accrue on January 1, 2027. This is equivalent to approximately $650 million each quarter.

- On February 9, 2026, Paramount certified that it has substantially complied with the U.S. Department of Justice's "second request" for information related to its tender offer to acquire WBD shares.

- Paramount continues to engage constructively with antitrust enforcers and other regulators around the world to expeditiously secure the regulatory clearances and approvals needed for its tender offer.

- Separately, Paramount already has secured clearance for its tender offer from the foreign investment authorities in Germany on January 27, 2026.

- In response to the concerns you raised publicly regarding our December 22 offer, we are introducing solutions which completely eliminate the $1.79 per share of value leakage WBD cited should Paramount's transaction not close:

- We will fully and promptly fund the $2.8 billion break fee to Netflix.

- We will fully reimburse the potential $1.5 billion cost for your debt refinancing, if incurred.

- We have identified straightforward solutions that provide certainty regarding the refinancing of WBD's bridge loan.

- Finally, if you have any latent concern that financial under-performance due to renewal of affiliate contracts at Discovery Global could cause us to declare a Material Adverse Effect under the proposed Paramount/WBD merger agreement and terminate the Paramount transaction, we would be prepared to discuss contractual solutions to address this.

- Our Revised Offer is fully financed by $43.6 billion of equity commitments from the Ellison Family and RedBird Capital Partners and $54.0 billion of debt commitments from Bank of America, Citigroup and Apollo.1

- These equity commitments also cover the cash enhancements to certainty listed above, including reserves for the ticking fee, the $2.8 billion break fee to Netflix, the $1.5 billion debt refinancing cost (if incurred) and any incremental breakage costs. As with our December 22 offer, Larry Ellison has provided an irrevocable personal guarantee, now of $43.3 billion, on the equity financing for our Revised Offer, the cash enhancements to certainty and any damages claims against Paramount.

While we have tried to be as constructive as possible in formulating these solutions, several of these items would benefit from collaborative discussion to finalize. If granted a short window of engagement, we will work with you to refine these solutions to ensure they address any and all of your concerns.

Our goal is to offer superior value and certainty to WBD shareholders -- our Revised Offer accomplishes both of these objectives.

Terms of Revised Proposal

- Offer Value: Each outstanding share of WBD Series A common stock will be exchanged for $30.00 per share in cash.

- This reflects a total equity value of $78 billion and enterprise value of $108 billion, including the assumption of net debt and noncontrolling interest.

- Ticking Fee: Paramount will offer WBD shareholders an incremental "ticking fee" to demonstrate its confidence in obtaining regulatory approval.

- As described below, Paramount has made substantial progress towards securing unconditional clearances from key antitrust agencies around the world.

- To underscore our confidence in the speed and certainty of our regulatory pathway, we will offer WBD incremental cash consideration of $0.25 per share each quarter between January 1, 2027, and the consummation of the Paramount transaction. This is equivalent to approximately $650 million each quarter.

- For the avoidance of doubt, if payable, this ticking fee will increase the cash consideration to WBD shareholders above our proposed $30.00 per share.

- Break Fee: Paramount will fund WBD's $2.8 billion break fee as a separate payment incremental to our cash offer price.

- Paramount will fund the payment of the $2.8 billion break fee due to Netflix concurrently with the termination of the Netflix agreement.

- This is laid out in our revised merger agreement that is filed with our Revised Offer.

- There will be no value leakage for WBD shareholders, and such payment will not reduce our separate $5.8 billion reverse termination fee.

- Debt Financing Cost: Paramount will eliminate WBD's potential $1.5 billion financing cost associated with its debt exchange offer.

- WBD has expressed concerns that the terms of Paramount's December 22 offer would unduly restrict WBD's ability to execute a debt exchange offer WBD must complete prior to December 30, 2026 to avoid paying bondholders a $1.5 billion fee.

- We have a simple solution to this concern that is both (i) risk-free and costless to WBD and (ii) beneficial to creditors:

- Paramount will agree to fully backstop an exchange offer that relieves WBD of its contractual bondholder obligations. This backstopped exchange results in no risk and no value leakage to WBD shareholders while delivering substantial value to WBD bondholders.

- This exchange will facilitate the proposed Paramount transaction while leaving bondholders and WBD no worse off in the unlikely event that the Paramount transaction fails to close.

- We are extremely confident that this will be successful, and therefore we will agree to fully reimburse WBD's shareholders for the $1.5 billion fee, without reduction to our separate $5.8 billion reverse termination fee, in the unlikely event that (i) the exchange is not successful, and (ii) the Paramount transaction does not close.

- We believe bondholders will strongly prefer our proposal, which is supported by $43+ billion of new cash equity in a scaled and broadly diversified media enterprise, to bondholders' current expected position of a second lien on the sub-scale, declining Discovery Global standalone business with uncertain equity value.

- Discovery Global Performance Uncertainty: We are prepared to address any concerns WBD has regarding the impact of Discovery Global's performance on closing certainty.

- To the extent that WBD is concerned that financial under-performance at WBD's Global Networks business could cause Paramount to declare a Material Adverse Effect under the proposed Paramount/WBD merger agreement and terminate the Paramount transaction, Paramount is prepared to discuss contractual solutions to address this concern.

- Bridge Loan Refinancing: Paramount will provide flexibility for WBD to refinance its existing $15 billion bridge loan.

- WBD has expressed concern that, should a transaction with Paramount fail to close, WBD will face uncertain future costs and terms to refinance the $15 billion short-term bridge loan it put in place last summer. We have multiple solutions to address this concern:

- WBD's current bridge lenders, led by J.P. Morgan, could simply extend the maturity of this facility.

- To the extent WBD's current lenders are not prepared to do this, Paramount's debt financing sources -- Bank of America, Citigroup and Apollo -- are fully prepared to tailor a solution to refinance this bridge loan and extend the maturity to facilitate this transaction.

- Our lenders have already provided much larger commitments under Paramount's $54 billion financing package that will refinance WBD's bridge loan at the close of the Paramount transaction.

- For the avoidance of doubt, any refinancing costs in this scenario would be covered by Paramount – and there would be no value leakage for WBD shareholders.

- Alternatively, we will permit WBD to structure the permanent financing in any way it chooses so long as the debt is redeemable at a commercially reasonable cost upon the close of the Paramount transaction. This is standard in strategic financings of this type.

- Ultimately, we are willing to engage in a collaborative discussion around the amount of "breakage costs" (e.g., call protection) we would be willing to bear on any new debt put in place by WBD.

- WBD has expressed concern that, should a transaction with Paramount fail to close, WBD will face uncertain future costs and terms to refinance the $15 billion short-term bridge loan it put in place last summer. We have multiple solutions to address this concern:

- Interim Operating Covenants: Paramount will provide WBD flexibility between signing and closing, including by matching any comparable Netflix interim operating covenants.

- Paramount commits to match any comparable interim operating covenants to which Netflix and WBD agreed.

- We do recognize that certain terms may not be comparable given the difference in structure between our two deals. Paramount will be constructive and flexible to provide WBD significant latitude to run its business between signing and closing.

- Committed Debt Financing: Paramount's debt financing sources have reaffirmed their commitments and pose no closing risk.

- WBD raised the certainty of our debt financing as a significant issue in its public response to our December 22 offer. Our previous binding merger agreement contained no financing condition and obligated us to close regardless of the availability of financing.

- Bank of America, Citigroup and Apollo have confirmed that the commitment letter previously delivered by them to provide $54.0 billion of debt financing to fund Paramount's proposed acquisition of WBD, regardless of future market conditions, remains in full force and effect.

- These are global sophisticated financial institutions, with decades of experience financing companies and borrowers in some of history's largest, most complicated transactions.

- We would also note that, including run-rate cost synergies, we estimate our net leverage at close will be 4.4x, with a clear path to rapidly de-levering in the near- to medium-term.

- Regulatory Approvals: Since the announcement of our tender offer, we have engaged in proactive and constructive communications with key antitrust regulatory agencies around the world to secure needed clearances as soon as possible.

- We have already made substantial progress in our efforts in securing those clearances, including having held meetings with and providing customary information to (i) the Antitrust Division of the U.S. Department of Justice, (ii) the European Commission, and (iii) the Competition and Markets Authority in the United Kingdom, among other bodies.

- On February 9, 2026, Paramount certified to the U.S. Department of Justice that it has substantially complied with the DOJ's "second request" for information related to its tender offer to acquire WBD shares.

- Paramount has secured clearance for its tender offer from the foreign investment authorities in Germany on January 27, 2026.

- We remain confident we can navigate the necessary clearances quickly and efficiently given the Paramount transaction does not raise any competition concerns.

- The same cannot be said of Netflix, which is dominant in streaming video on demand in the US, EU and dozens of other jurisdictions, and the Netflix transaction will face a long and uncertain regulatory approval process, with a very low likelihood of clearance in any substantial jurisdiction.

Our Superior Proposal

We have always believed our previous offer was superior to the Netflix transaction. With these above described enhancements to value and certainty, our Revised Offer is undoubtedly superior to the Netflix transaction:

- Our $30.00 all cash Revised Offer (before any ticking consideration) represents more cash to WBD shareholders than the headline $27.75 per share offered under the Netflix transaction, which is subject to an uncertain reduction based upon the net debt allocated to the rapidly declining Discovery Global.

- We believe the spin-off of Discovery Global has negligible equity value, given the ~$17 billion of debt that WBD plans to allocate to the business. This is an unsustainable amount to support for a cable networks business anticipating a 22% EBITDA decline from 2026 to 2027 and continued double digit declines thereafter.

- As a result, we expect some portion of this debt to be reallocated to the Studio & Streaming business, which in the Netflix transaction would trigger a "debt adjustment mechanism" whereby cash consideration to WBD shareholders will be reduced on a 1:1 basis.

- Based on where the most relevant comparable company, Versant, currently trades, at ~3.5x forward EBITDA while capitalized at 1.25x net leverage, it is likely that approximately ~$12 billion of proposed Discovery Global debt will have to be transferred to the Studio & Streaming business to reduce leverage at Discovery Global from the proposed 4.2x level to a more realistic 1.25x level as borne out by the Versant comparable.2

- This debt reallocation would result in a ~$12 billion dollar-for-dollar reduction in cash proceeds to WBD shareholders, reducing the headline $27.75 per share Netflix transaction price by $4.55 per share, thereby reducing the total cash to WBD shareholders by 16% to $23.20 per share.3

- As WBD's own merger proxy acknowledges, the Netflix transaction leaves WBD shareholders with significant uncertainty regarding how much cash they will receive and how much exposure they will have to the declining Discovery Global business. According to WBD's own February 9 disclosure, the Netflix cash consideration could be as low as $21.23 per share.

- Additionally, considering the Paramount transaction's higher certainty and shorter path to close – relative to a Netflix transaction that faces substantial regulatory scrutiny and a long, drawn-out timeline – our $30.00 all-cash Revised Offer reflects an even greater premium to $27.75 on a present value basis. The present value of the $27.75 headline Netflix transaction price is reduced to ~$26.45 if the Netflix transaction takes just six months longer to close – a ~$1.30 per share reduction to WBD shareholders.4

- In other words, after accounting for the time value of money, our $30.00 all-cash Revised Offer should be compared to ~$26.45 in cash consideration from Netflix, not $27.75, even if you disregard the net debt adjustment outlined above. And unlike the Netflix transaction, which exposes WBD shareholders to this value destruction over the course of its long and uncertain approval timeline, our Revised Offer compensates WBD shareholders for any unanticipated delay in closing through an incremental ticking fee.

We note that, to engage with Paramount under the terms of the Netflix agreement, you must simply conclude that this Revised Proposal could reasonably lead to a superior outcome for your shareholders. We are highly confident our Revised Proposal surpasses this standard as a superior package to the Netflix agreement.

We appreciate this has been a long and involved process for all parties. We believe we have a path to bring this to a rapid conclusion that would be in the best interests of WBD and its shareholders. We hope you will decide to engage with us to enable that value-maximizing outcome.

Sincerely,

David Ellison

Chairman and Chief Executive Officer

Paramount Skydance Corporation

Shareholders with questions about how to vote their WBD shares AGAINST the inferior Netflix transaction may contact Paramount's proxy solicitor Okapi Partners at (212) 297-0720, Toll-Free: (844) 343-2621, or by email at info@okapipartners.com.

Paramount has amended its tender offer in accordance with the terms of its enhanced superior proposal for WBD and extended the expiration date of its tender offer to March 2, 2026. Equiniti Trust Company, LLC, as the depositary for the tender offer, has advised Prince Sub that, as of 5:00 p.m., New York City time, on February 9, 2026, 42,345,815 shares had been validly tendered and not withdrawn from the tender offer.

The tender offer statement and related materials have been filed with the SEC. WBD shareholders who need additional copies of the tender offer statement and related materials or who have questions regarding the offer should contact Okapi Partners LLC, the information agent for the tender offer, toll-free at (844) 343-2621.

PARAMOUNT URGES WBD SHAREHOLDERS TO REGISTER THEIR PREFERENCE FOR PARAMOUNT'S SUPERIOR OFFER WITH THE WBD BOARD OF DIRECTORS BY TENDERING THEIR SHARES TODAY.

WBD shareholders and other interested parties can find additional information about Paramount's superior offer at www.StrongerHollywood.com.

1 Committed equity funding includes (i) $40.8 billion to fund $30.00 per share equity purchase price, (ii) $2.8 billion to fund break fee to Netflix and (iii) additional cash reserves.

2 Based on $17.0 billion of net debt and $4.1 billion of NTM EBITDA as of June 30, 2026, per WBD's disclosed financial projections for Discovery Global (Adjusted EBITDA Post-SBC of $4.6 billion for 2026 and $3.6 billion for 2027).

3 Calculated using a total of 2,612,605,808 shares of WBD Common Stock, per WBD disclosure.

4 Reflects an illustrative 10% discount rate applied to $27.75 in consideration over a 6-month period.

About Paramount, a Skydance Corporation

Paramount, a Skydance Corporation is a leading, next-generation global media and entertainment company, comprised of three business segments: Studios, Direct-to-Consumer, and TV Media. Paramount's portfolio unites legendary brands, including Paramount Pictures, Paramount Television, CBS – America's most-watched broadcast network, CBS News, CBS Sports, Nickelodeon, MTV, BET, Comedy Central, Showtime, Paramount+, Paramount TV, and Skydance's Animation, Film, Television, Interactive/Games, and Sports divisions. For more information, visit paramount.com.

PSKY-IR

Cautionary Note Regarding Forward-Looking Statements

This communication contains both historical and forward-looking statements, including statements related to Paramount Skydance Corporation's ("Paramount") future financial results and performance, potential achievements, anticipated reporting segments and industry changes and developments. All statements that are not statements of historical fact are, or may be deemed to be, "forward-looking statements". Similarly, statements that describe Paramount's objectives, plans or goals are or may be forward-looking statements. These forward-looking statements reflect Paramount's current expectations concerning future results and events; generally can be identified by the use of statements that include phrases such as "believe," "expect," "anticipate," "intend," "plan," "foresee," "likely," "will," "may," "could," "estimate" or other similar words or phrases; and involve known and unknown risks, uncertainties and other factors that are difficult to predict and which may cause Paramount's actual results, performance or achievements to be different from any future results, performance or achievements expressed or implied by these statements. These risks, uncertainties and other factors include, among others: the outcome of the tender offer by Paramount and Prince Sub Inc. (the "Tender Offer") to purchase for cash all of the outstanding Series A common stock of Warner Bros. Discovery, Inc. ("WBD") or any discussions between Paramount and WBD with respect to a possible transaction (including, without limitation, by means of the Tender Offer, the "Potential Transaction"), including the possibility that the Tender Offer will not be successful, that the parties will not agree to pursue a business combination transaction or that the terms of any such transaction will be materially different from those described herein; the conditions to the completion of the Potential Transaction or the previously announced transaction between WBD and Netflix, Inc. ("Netflix") pursuant to the Agreement and Plan of Merger, dated December 4, 2025 (as it may be amended or supplemented), among Netflix, Nightingale Sub, Inc., WBD and New Topco 25, Inc. (the "Proposed Netflix Transaction"), including the receipt of any required stockholder and regulatory approvals for either transaction, the proposed financing for the Potential Transaction, the indebtedness Paramount expects to incur in connection with the Potential Transaction and the total indebtedness of the combined company; the possibility that Paramount may be unable to achieve expected synergies and operating efficiencies within the expected timeframes or at all and to successfully integrate the operations of WBD with those of Paramount, and the possibility that such integration may be more difficult, time-consuming or costly than expected or that operating costs and business disruption (including, without limitation, disruptions in relationships with employees, customers or suppliers) may be greater than expected in connection with the Potential Transaction; risks related to Paramount's streaming business; the adverse impact on Paramount's advertising revenues as a result of changes in consumer behavior, advertising market conditions and deficiencies in audience measurement; risks related to operating in highly competitive and dynamic industries, including cost increases; the unpredictable nature of consumer behavior, as well as evolving technologies and distribution models; risks related to Paramount's decisions to make investments in new businesses, products, services and technologies, and the evolution of Paramount's business strategy; the potential for loss of carriage or other reduction in or the impact of negotiations for the distribution of Paramount's content; damage to Paramount's reputation or brands; losses due to asset impairment charges for goodwill, intangible assets, FCC licenses and content; liabilities related to discontinued operations and former businesses; increasing scrutiny of, and evolving expectations for, sustainability initiatives; evolving business continuity, cybersecurity, privacy and data protection and similar risks; content infringement; domestic and global political, economic and regulatory factors affecting Paramount's businesses generally, including tariffs and other changes in trade policies; the inability to hire or retain key employees or secure creative talent; disruptions to Paramount's operations as a result of labor disputes; the risks and costs associated with the integration of, and Paramount's ability to integrate, the businesses of Paramount Global and Skydance Media, LLC successfully and to achieve anticipated synergies; volatility in the prices of Paramount's Class B Common Stock; potential conflicts of interest arising from Paramount's ownership structure with a controlling stockholder; and other factors described in Paramount's news releases and filings with the Securities and Exchange Commission (the "SEC"), including but not limited to Paramount's most recent Annual Report on Form 10-K and Paramount's reports on Form 10-Q and Form 8-K. There may be additional risks, uncertainties and factors that Paramount does not currently view as material or that are not necessarily known. The forward-looking statements included in this communication are made only as of the date of this report, and Paramount does not undertake any obligation to publicly update any forward-looking statements to reflect subsequent events or circumstances.

Additional Information

This communication does not constitute an offer to buy or a solicitation of an offer to sell securities. This communication relates to a proposal that Paramount has made for an acquisition of WBD, the Tender Offer that Paramount, through Prince Sub Inc., its wholly owned subsidiary, has made to WBD stockholders, and Paramount's intention to solicit proxies against the Proposed Netflix Transaction and other proposals to be voted on by WBD stockholders at the special meeting of WBD stockholders to be held to approve the Proposed Netflix Transaction (the "Netflix Merger Solicitation") and/or for use at the WBD annual meeting of stockholders. The Tender Offer is being made pursuant to a tender offer statement on Schedule TO (including the offer to purchase, the letter of transmittal and other related offer documents), filed with the SEC on December 8, 2025. These materials, as may be amended from time to time, contain important information, including the terms and conditions of the offer. Subject to future developments, Paramount (and, if a negotiated transaction is agreed, WBD) may file additional documents with the SEC. This communication is not a substitute for any proxy statement, tender offer statement, or other document Paramount and/or WBD may file with the SEC in connection with the Potential Transaction.

Paramount, Prince Sub Inc. and the other participants in the Netflix Merger Solicitation have filed a preliminary proxy statement and the accompanying BLUE proxy card with the SEC on January 22, 2026 in connection with the Netflix Merger Solicitation (the "Special Meeting Preliminary Proxy Statement"). Paramount expects to file a definitive proxy statement and the accompanying proxy card with the SEC in connection with the Netflix Merger Solicitation and may file other proxy solicitation materials in connection therewith or the annual meeting of WBD stockholders, or other documents with the SEC.

PARAMOUNT STRONGLY ADVISES ALL STOCKHOLDERS OF WBD TO READ THE SPECIAL MEETING PRELIMINARY PROXY STATEMENT AND OTHER PROXY MATERIALS AS THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION, INCLUDING INFORMATION RELATED TO THE PARTICIPANTS. SUCH PROXY MATERIALS WILL BE AVAILABLE AT NO CHARGE ON THE SEC'S WEB SITE AT HTTP://WWW.SEC.GOV. IN ADDITION, PARAMOUNT AND THE OTHER PARTICIPANTS IN SUCH PROXY SOLICITATIONS WILL PROVIDE COPIES OF THE APPLICABLE PROXY STATEMENTS WITHOUT CHARGE, WHEN AVAILABLE, UPON REQUEST. REQUESTS FOR SUCH COPIES SHOULD BE DIRECTED TO THE APPLICABLE PROXY SOLICITOR.

Participants in the Solicitation

The participants in the Netflix Merger Solicitation are expected to be Paramount, Prince Sub Inc., certain directors and executive officers of Paramount and Prince Sub Inc., Lawrence Ellison, RedBird Capital Management and The Lawrence J. Ellison Revocable Trust, u/a/d 1/22/88, as amended. Additional information about the participants in the Netflix Merger Solicitation is available in the Special Meeting Preliminary Proxy Statement.

Media Contacts:

Paramount

Melissa Zukerman / Laura Watson

msz@paramount.com / laura.watson@paramount.com

Brunswick Group

ParamountSkydance@brunswickgroup.com

Gagnier Communications

Dan Gagnier

dg@gagnierfc.com

Investor Contacts:

Paramount

Kevin Creighton / Logan Thomas

kevin.creighton@paramount.com / logan.thomas@paramount.com

Okapi Partners

(212) 297-0720

Toll-Free: (844) 343-2621

info@okapipartners.com